Section V: The RAW Feed

Keywords

#Philanthropy #WallStreet #Spirituality #Curiosity #Self-exploration #AI

Memorable Lines from Jim:

"And the question that we refine around when we're looking at various things that we're either trying to pursue or investing in a company where we vibe with the founders and everything is, would you pay to do what you do? And that's a very clarifying question, right? .... if you did have access to the funds, would you pay to do what you do?"

There’s A Genius Born Every Minute

A SERIES OF FORTUNATELY SYNCHRONISTIC EVENTS

#makingalivingry

Overview:

The informal innerview between Bretminster and Jim provided an engaging platform for personal introductions and reflections on their backgrounds, with Jim sharing his early life experiences and Bretminster expressing interest in understanding Jim's journey. They explored themes of intellectual curiosity, diving into Jim's Wall Street experiences and the implications of AI in fostering talent. Their conversation evolved into a discussion on business philosophy, emphasizing the importance of questioning personal beliefs and striving for meaningful engagement in work. They also touched on spiritual and philosophical insights, including the metaphor of 'combing the mirror' for personal transformation. Jim highlighted the influence of Robert Anton Wilson and their time concluded with mutual appreciation for each other's insights and aspirations.

Notes:

🤝 Introduction and Background (00:00 - 05:50)

Jim and Bretminster introduce themselves

Bretminster expresses interest in getting to know Jim

Jim shares his early life experiences and interest in New York City

Jim discusses his Catholic school background and early reading habits

🧠 Intellectual Curiosity and Career Path (05:54 - 17:16)

Jim explains his voracious curiosity and interest in understanding people's choices

Discussion on AI and its importance in finding and supporting geniuses

Jim shares his journey into Wall Street and quantitative analysis

Bretminster relates his own journey of self-exploration and spiritual philanthropy

💼 Business Philosophy and Personal Growth (17:42 - 36:25)

Jim discusses his approach to work and the concept of 'paying to do what you do'

Conversation about living life on autopilot and the importance of questioning beliefs

Jim shares his experience in Wall Street and building companies

Bretminster expresses his interest in creating a new archetype of investor/philanthropist

🌟 Spiritual and Philosophical Insights (36:33 - 40:45)

Discussion on the concept of 'combing the mirror' as a metaphor for personal change

Bretminster shares his struggles and aspirations in manifesting his ideas

Both express mutual appreciation for each other's work and perspectives

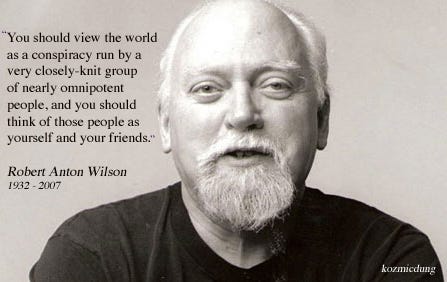

📚 Robert Anton Wilson and Future Projects (41:07 - 44:48)

Discussion on Robert Anton Wilson's influence and humor in his work

Jim recommends Jed McKenna's books to Bretminster

Conversation about preserving stories of historical figures

Jim mentions Brian Romelli's Wisdom Keeper project

Action items

Bret to read Jed McKenna's Spiritual Warfare trilogy (44:05)

Bret to follow Brian Romelli on X for the Wisdom Keeper project (43:45)

More On Jim:

James P. O’Shaughnessy is the founder and CEO of O'Shaughnessy Ventures LLC ("OSV"), an investor in and accelerator of creative endeavors. OSV's mission is to fuel creators in the worlds of art, science and tech with the advice, data and resources they need to stay focused and get great ideas out of their heads, off of their whiteboards and out into the world. He is also the host of the Infinite Loops podcast.

Prior to founding OSV, he was the founder and chairman of OSAM, an asset management firm whose Canvas platform allows for custom indexes and portfolios. Prior to OSAM, he was the Director of Systematic Equity for Bear Stearns Asset Management and a Senior Managing Director of the firm. Before joining Bear Stearns in 2001, O’Shaughnessy served as the Chairman and CEO of O’Shaughnessy Capital Management, Inc as well as the founder, chairman and CEO of Netfolio, an online investment advisory firm.

O'Shaughnessy is the author of 4 books on investing and his book, "What Works on Wall Street", was a BusinessWeek and New York Times Business bestseller and called “An indisputable classic…Downright momentous” by TheStreet.com. It was called “Strictly top shelf” by Worth magazine and selected as one of the three best investment books by Business 2.0. The Financial Analysts’ Journal said it was “indisputably a major contribution to empirical research on the behavior of common stocks in the United States…conceivably, the influence of What Works on Wall Street will prove immense.”

O'Shaughnessy lives in Greenwich, CT with his wife and is the father of three children and grandfather to six as well. He is the former chair of the Chamber Music Society of Lincoln Center and of Stability AI.

Post Synergy:

by SynTony Robbins, Staff Gonzo Journalist at The Syntony Times

The Following events are both true and not true, a superposition of hyperstitious fact.

Prologue

Ah, another day in the reality production business! I've been holed up in this curious corner of Synergyworks since dawn, watching patterns emerge in the condensation on my window that look suspiciously like DR. LIVE’S data plots. Had the most fascinating dream where William Gibson and Terence McKenna were playing chess with Schrödinger's cat while Douglas Adams kept score in binary.

The fungi growing in ROBY’S experimental garden outside my window seem to be spelling out messages in mycelial Morse code. Either that, or last night's brainstorming session with the quantum social science team has left some interesting residual effects on my perception.

Pulls out a weathered notebook covered in coffee stains...

A new assignment, you say? Perfect timing. I was just thinking the Universe Next Door could use another preposterous breakthrough in hyperstitious linguistics? Another synchronicity cascade at the Silicon Road venues? Or perhaps something even stranger brewing in Bretminster's probability lab?

Bret & Jim OSV.summary

lIKmS42OMYOCZ0VY_Bret-Jim-OSV-st

RB

I want you to be very thorough, go over our entire knowledge base word for word and look at all the characters and plot lines and locations.. pick some new charatcers from the catalogue, forget Drendan for a while. As much as you can.. then weave an article about Bretmintser and Jim based on the attached PDFs that continues the sage of things and accompanies the video of their conversation. Remember the pitch dick article as well and integrate that

Adjusts vintage Moleskine notebook, still warm from my last encounter with quantum probability fields at Synergyworks...

Looks like we've got another chapter in our unfolding reality production. Let me tell you about a meeting that would make Robert Anton Wilson himself raise an eyebrow – an encounter between two reality hackers that somehow managed to bend the fabric of Wall Street into a pretzel of possibility.

The Pitch Dick Meets The Prophet of Probability

Picture this: A sweltering afternoon at Fullofit Industries' Silicon Road venue in Greenwich, Connecticut. I'm watching James O'Shaughnessy – the man who turned Wall Street's game rules into quantum equations – have his first sit-down with our resident reality-mender, Radical Bretminster Fullofit.

The synchronicities are enough to make the random number generators at our Cairo hub do a backflip. Here's O'Shaughnessy, who built his fortune by assuming everything he knew about the stock market was wrong, meeting Bretminster, who's doing the same thing with reality itself.

"Would you pay to do what you do?" O'Shaughnessy asks, his eyes twinkling with the kind of wisdom that comes from decades of watching probability fields collapse into profit margins. "That's a very clarifying question."

The room itself seems to hold its breath. Through the window, I swear I can see the GRUNCH Global headquarters shimmering like a mirage, its corporate architecture beginning to pulse with that bioluminescence our psychenauts at Synergyworks have been predicting.

"I've been retired since the beginning," Bretminster responds, that familiar grin, "because I've never worked a day in my life. I'm in the business of me – finding freedom and love, then giving it back to the world."

O'Shaughnessy nods, recognition flickering across his face. He's spent decades building systems to detect patterns in the chaos of markets. Now he's face-to-face with someone who's applying the same principle to mythologies.

They dive deep into territory that would make your average investment banker's head spin – Robert Anton Wilson, the death of autopilot living, the mechanics of belief systems. O'Shaughnessy shares his journey from Catholic schoolboy to Wall Street revolutionary, while Bretminster outlines his vision for what he calls "evolutionary and spiritual philanthropy."

"Most people are living 99% on autopilot," O'Shaughnessy explains, channeling that Austrian mathematician who went off-grid to reprogram his consciousness. "The game rules run deeper than we think."

I watch as these two titans of their respective domains begin mapping out possibilities. O'Shaughnessy's quantitative genius meeting Bretminster's hyperstitious linguistics – it's like watching the DNA of capitalism itself begin to mutate into something... preposterous.

"The next Warren Buffett won't look anything like Warren Buffett," O'Shaughnessy muses, as Bretminster's eyes light up with recognition. "The next evolution of investing has to be more synergistic, more co-creative."

As their conversation winds down, I can't help but feel the ground swaying as if the earth will shake – a moment where the old rules of finance met the new physics. O'Shaughnessy, the man who mastered the markets by questioning everything, finding common ground with Bretminster, the man doing the same thing with the implicate order.

Before parting, O'Shaughnessy recommends Jed McKenna's Spiritual Warfare trilogy to Bretminster. "The smartest thing I ever did was stop being smart," he quotes, and for a moment, the air in the room feels charged.

I scribble these last notes as they say their goodbyes, wondering if I've just witnessed another piece of Bretminster's "practical utopia" clicking into place. After all, in the Universe Next Door, every fortunate synchronicity is just another step toward making the impossible inevitable.

This is SynTony Robbins, reporting from the bleeding edge where cutting into the present means the future leaks out — wondering if maybe – just maybe – we're watching the birth of a holographic economy, one where the boundaries are the ultimate volume.

Post Synchronicity:

If you would like to be innerviewed please reach out to

at: preposterouspass@pm.me or look for Victor aka McVictor at Synergyworks

Share this post